AUSTIN, TX / ACCESSWIRE / January 24, 2023 / Silo has officially opened up its waitlist and has launched its app in the iOS app store. The company is currently in the process of testing the platform with its beta users, whom they have been letting off the waitlist since December 20, 2023.

Silo Markets is a novel modern bond platform that introduces a new way for younger investors to get started with bond investments. The company is targeting millennials in particular and seeks to offer this demographic a streamlined method of engaging with the conservative fixed income market. Silo is designed to make bond investment both accessible and appealing to a younger audience.

Silo Markets was created with a blend of technology, simplicity, and security and is focused on the often-overlooked realm of bond investing, an investment class typically associated with older generations. Silo recognizes that millennials hold a substantial portion of their assets – approximately 65% – in cash due to the lingering effects of the 2008 financial crisis, with 80% of millennials acknowledging its ongoing impact on their investment decisions.

This apprehensive attitude has led to about 25% millennials amassing savings exceeding $100,000; yet their participation in the stock market remains notably lower than levels seen two decades ago.

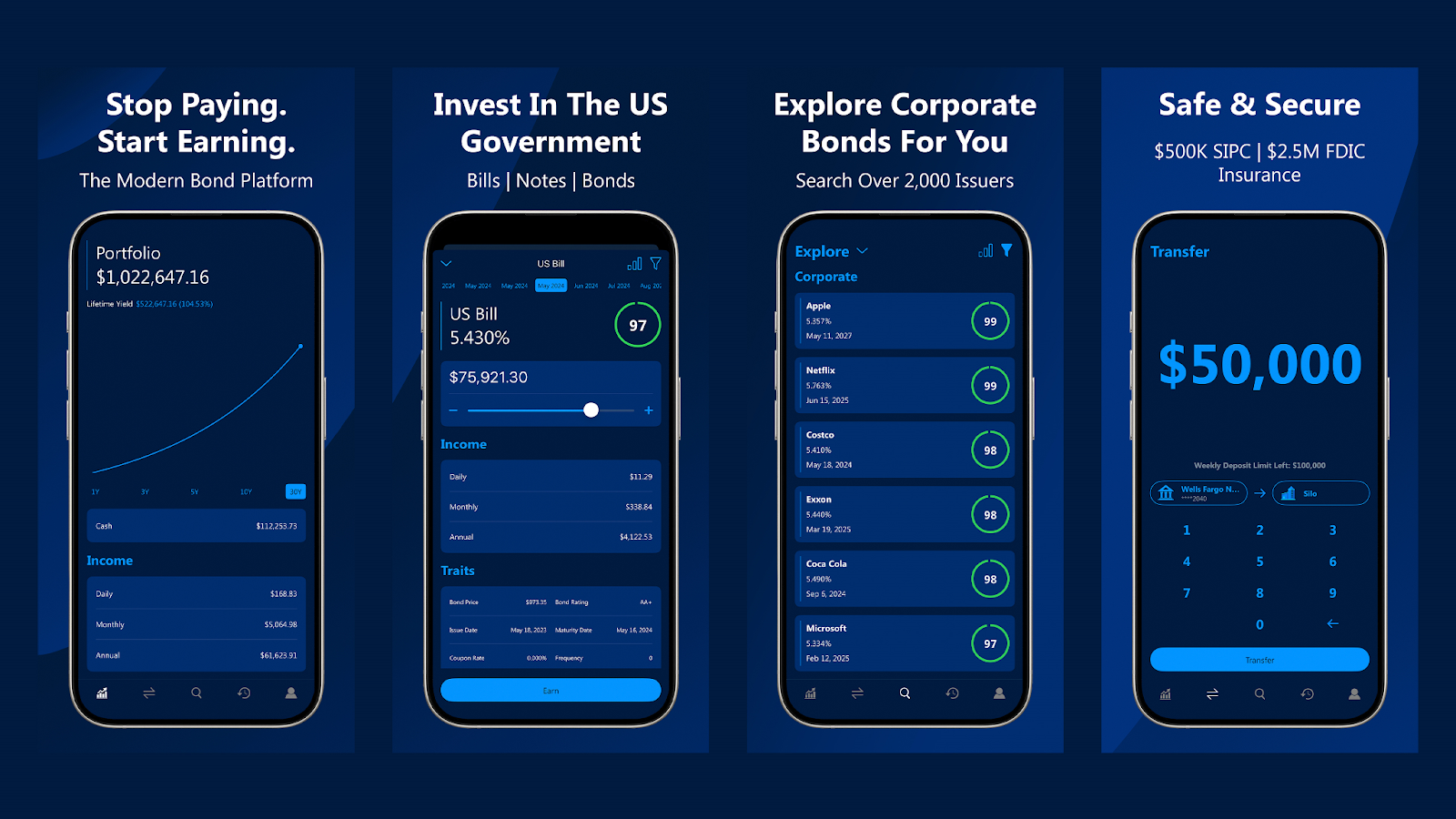

Silo Markets offers up to 5.38% APY on government bonds and up to 9.73% from investment-grade corporate bonds (as of December 2, 2023). This attractive opportunity provides a potentially lower risk compared to stock market ventures. Silo’s strategy revolves around empowering investors to earn from well-known corporations, flipping the traditional credit card interest narrative on its head.

The Silo iOS app, open to US residents, allows individuals to easily purchase and invest in corporate bonds and government bills, notes, bonds, and TIPs. Whether users choose the app or the website, they have access to a comprehensive suite of educational modules meant to convey the concept that genuine investment is a disciplined and thoughtful strategy for long-term wealth accumulation.

Silo’s mission is to introduce this ethos to the bond market, encouraging responsible and calculated investment decisions. This approach stands in stark contrast to the current trend of speculative and high-energy trading, advocating for a more stable and secure path to financial growth, particularly suitable for the millennial investor.

With an understanding of the diverse needs of the modern investor, Silo plans to introduce funds by 2025. These funds allow users to tailor their investment strategies according to their own personal goals, risk tolerance, and timelines. This helps to create a personalized financial journey towards achieving life milestones like buying a house or saving for retirement.

Silo’s team strives to provide users with a seamless investing experience by utilizing advanced technology. For example, the platform employs a dynamic suitability algorithm that continuously adapts to the changing financial needs of its users. This means that users can choose from a broad spectrum of fixed income options. An automated investing feature like this eliminates the need for costly financial advisors and allows for more efficient investment management.

As stock market volatility is always a concern, Silo’s team feels that bonds may be a safer and more stable investment option. Silo offers both corporate and government bonds to cater to various risk appetites. Corporate bonds have the potential for higher yields; but government bonds are typically lower risk.

One way to counteract inflation is to invest in Treasury Inflation Protected Securities (TIPS). TIPS adjust the principal based on current inflation rates, ensuring that investors’ purchasing power is not eroded over time.

The team at Silo have studied the bear market and have noted the advantages of bond investing. As investors seek refuge from volatile markets, bonds are potentially a safer haven. Silo does advise caution, recommending investment in highly rated bonds to avoid defaults by fragile companies.

Silo’s developers are pleased and excited about the pending launch. The company invites interested parties to join the waitlist. Silo is hoping to open up the platform to everyone on February 1, 2024 and will update its website with any changes.

About Silo Markets

Silo Markets is a novel bond investment platform designed to provide greater accessibility to the field of conservative fixed income investing. The company targets millennials and has created a user-friendly interface offering investment opportunities with a focus on long-term financial growth. Silo has been letting US residents into its iOS app since December 20, 2023. The content in this article is meant to be informative and should not be construed as financial advice.

Website: https://www.silomarkets.com/waiting-list-page?utm_source=yahoo&utm_medium=article

App: https://apps.apple.com/us/app/silo-invest-in-bonds/id1630228218

Contact:

Akhsheiy Tangutur

Email: [email protected]

SOURCE: Silo Markets

View the original press release on accesswire.com